Cost Accounting Assignment Help

Question 1- discussion based- This question relates to the topic of measuring relevant costs and revenues from the student's choice of two from four of the decision making situations outlined in chapter 4 (page 83) of the core text book (edition 6) .

Question 2-discussion based- This question is in two parts the topic covers budgeting and the budget process. For the first part the intention is to provide a broad based question which will allow the student to display an appropriate level of understanding for the subject as a whole. For the second part again on budgeting this is a more focused question on comparing the traditional budgeting approach with contemporary approaches.

Enroll with Cost Accounting Assignment Help solution and homework writing services of Expertsminds.com and get better results in assignments!

Question 1: Measuring of Relevant Costs and Revenues

Measuring the costs and revenue in the special situations involving special orders which is generally outside of the firms primary operating market and especially where the firm concerned has excess capacity is a thought provoking one. In these situation, the firm's management is confronted with a new order in which the buyers proposes to buy some of the goods form the firm at a price which is lower than the market price. As the special order prices are lower than the market price, most managers would have to deal with the same fully knowing that they would be bale to accept the orders only if the new orders acceptance and fulfillment is going to increase the profitability of the firm. As such the new orders would be accepted only if the new price being offered is higher than the variable costs of production (Drury, Cost and management accounting : an introduction, 2006 ).

For making sure the right decisions regarding the acceptance of the order is undertaken and the same is in the best interest of the company, it must be ensured that the management and the decision maker must understand the costs which are relevant for such decisions making.

Relevant decisions are those costs under these circumstances which would be expected to change as orders are accepted and more is produced and mostly they would be variable or direct costs of reductions like that of direct materials and direct labour etc.

Irrelevant costs are those costs under these circumstances which are not expected to change and remains unchanged or fixed even if the orders are accepted and capacity utilizations are increased. Mostly these costs are fixed costs in nature and they are already fully recovered by the company.

However, some of the fixed costs in nature can be relevant to the decisions regarding these specific orders if they are expected to change as the orders are accepted. If some of th fixed costs are seen to be increasing as a result of the new orders they would be regarded as relevant costs and must be included in the decisions making process to find out if the order can be accepted.

Tak, for example, ABC company is currently producing 100,000 units and selling them @ $50. The variable costs incurred are as follows:

Direct Materials per unit = @ 20

Direct labour per unit is 12 per unit

Variable manufacturing costs per unit is 3 per unit.

Fixed costs per annum is $500,000.

The current profit is $1,000,0000 ( $5,000,000- $2,000,000- $1,200,000- $300,000-$500,000)

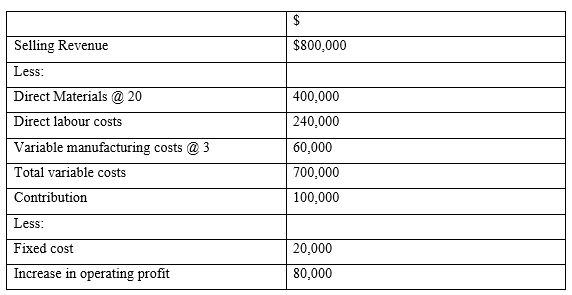

Now the company has received a new order under which the company would need to sell additional 20,000 units @ 40 per unit. The ABC company has excess capacity to produce the 20,000 units and they would be required to spend an additional fixed costs of $20,000.

If the new order is accepted then :

As the operating profit is expected to increase by $ 80,000, the same shall be accepted and fixed costs apart from the variable costs are relevant because it is changing and would affect the profitability.

Questions 2 :

Budgeting and its impact on long term objectives of a company

Budget can be defined as a tool which quantifies all the items and expresses the final result as an objective for the managers to achieve. Thus it acts as a goal for the management and aids in the planning of actual operations in the next year or so. As the budget is prepared keeping the goals in mind and quantifies the goals the same actually provides an insight into how the same would be achieved and helps in the communication process and actually increases cooperation between department heads and others. Budgets presented in a better layout and which is well understood by the managers and supervisors would-be expectedto motivate managers to strive to achieve the budget goals and work towards achieving those goals in the target time frame. It also serves as a benchmark for the managers and actual results can be compared against the goals to knowhow and where and why the variations have occurred and let the management take necessary steps to make sure the same does not occur again in the future.

Comparing the traditional budgeting approach to contemporary Approaches

Traditional budgets are based on the fact that they are generally prepared for a specific period of 12 months or so. This means it can't accommodate changes which occurs midway and would not accommodate changes in the budgeted environment. Further, under traditional budgeting, the next year's budget is based on the previous years estimates and hence are arbitrary in nature. Furthe, the traditional budgets are prepared on the basis of historical costs and does not consider cost effectiveness to be implemented as a goal. Thus it fails to achieve control over costs and assigns a large portion of the budgeted amounts on an arbitrary basis in the current period (Bhimani, Datar, & Horngren, 2017).

Contrary to traditional budgeting the contemporary budgeting methods such as Zero based budgeting does not depend upon previous budgets and allocations are done entirely new. The departmental heads are asked to prepare their budgets from scratch and then the organization wide budget is prepared. Zero based budgeting is prepared keeping in mind the expectation of the future and not past. Each items which is included in the zero based budgeting is estimated as per new requirements and also considers cost effectiveness. Each items has to be fully justified by the managers to be able to get cost allocations. However, unlike thetraditional budgeting process, it requires more time frame for preparation and needs larger documentation on the part of the managers. However, the same would be effective in allocating desired funds for desired goals (Drury, Cost and Management Accounting: An Introduction, 2010).

The effetvieness of the traditional budegts are fully depdendent upon the effectiveness of the previous years budegts and how well the same was prepapred. But the effectiveness of thecontemporary budegts such as the zero based budgeting requires active support and preparedness of the top managers and of the company and how they support the budgeting activities.

Expertsminds.com gives accountability of your time and Money – Avail TOP results originated Cost Accounting Assignment Help services at best rates!