FIN201 Investment Management Assignment - King's Own Institute, Australia

Topic: You are required to build a portfolio as at 30 September, 2018, track the performance of your individual investments on a monthly basis through to the end of March, 2019, and submit a report on the rationale of the original portfolio construction (in September, 2018) and its half-yearly performance from 1 October, 2018 to 31 March, 2019.

ENROL WITH FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENT HELP AND HOMEWORK WRITING SERVICES OF EXPERTSMINDS.COM AND GET BETTER RESULTS IN FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENTS!

Answer - Investment Policy Statement

Executive Summary -

The following assignment developes an Investment policy statement for a sporting organisation. The Policy statement also discusses various asset allocation activities by justifying each allocation. The statement will also outline some of the major issues related to the operations of the sporting organisation. An investment Policy Statement will assist during the governing of the investment program comprising of all asset management of the local sporting organisation sports management plan.

Part 1 - Prepare an investment policy statement for the local sporting organisation based on what you learn in Topic.

Answer - Investment Policy Statement

The investment policy statement is presented for the identified sports firm.

1. Purpose

The investment policy statement to be presented in this paper will ensure efficient management of assets based on statutory fiduciary requirements. The objectives mentioned are specific, meaningful and flexible in order to support market differences and variations in economy in the sports industry (Röder & Walter, 2019). The objectives proposed in this paper need to be achieved in prudent manner keeping in mind effects of inflation, returns, economic conditions, taxation impacts and the role played by each investment in the overall portfolio.

Fiduciary here is sporting organization and it will take care of asset management of entire plan. The board should use information as follows for the plan - different asset allocations and comparison of allocation to current investment attitude (Kim, 2016). The asset here has the potential to set adequate information supporting the plan. As a result, it is important for the allocation to be installed by discretionary trustee keeping in mind the factors mentioned above. In this regard, the investment intentions in addition to allocation of assets will also reflect to the current attitudes in respect to assets of the plan as per the board. It is also important to note that all the assets should be reviewed to understand the expectations as fixed for this plan.

1. Functions of the Policy Statement

Based on the fiduciary responsibilities, the investment policy statement adopted by the board should adhere to the following:

a. Establish objectives, guidelines and expectations related to investments of assets.

b. Develop an investment structure for asset management. This has to include investment management style, the target asset allocation and ensure production of diversity in the results in addition to the adjustment of the total risk over a long period.

c. Presence of valid guidelines in investment portfolio to control risk and liquidity. As a result, assets will be managed as per the plan.

d. Establish criteria for monitoring results.

24/7 AVAILABILITY OF TRUSTED FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENT WRITERS! ORDER ASSIGNMENTS FOR BETTER RESULTS!

2. Liquidity requirements

The objective of this investment plan is to confirm growth of plan in a prudent method. This methodology associated with investment plan and asset management can guarantee benefits to the participants. The policy needs developed will also have to match with unforeseen requests or periodic disbursement in regard to other financial assets which are most likely to meet the needs of different cash flow (Kim, 2016).

When the need matches the objectives and timing of any type of future liability, it is possible to minimize the investment risk. Further, this can control the cash flow of assets belonging to organization in the future.

It is essential for trust company to manage assets by considering certain factors - general conditions, inflation/deflation, taxation consequences, investment strategies, decisions, institution needs and proposal to address liabilities. It should also address the relationship between the assets and offer special value to promote the objective of institution (Kim, 2016). The trust company has to do its best to diversify the plan investments to achieve all of the points mentioned.

3. Return Requirements

When it comes to requirements of the returns, the investment policy statement generally considers absolute returns and relative returns. In the case of absolute returns, the growth of plan assets is analysed in the form of dollar in the policy statement. The mission will be to assess the average total annual return and compare it with the desired rate of return expected from the plan. It is important to measure return as it influences the complete market cycle for a period of 5 years.

On the other hand, relative return implies the comparison of weighted total return to various marked incidences of the organization (Kim, 2016). Further, the indices of capital market are combined to enrich the action plan. The return is usually computed for a long term, anywhere between 3 and 5 years (Hovey & Wysel, 2011).

4. Asset Allocation and Ranges of operation

In order to achieve the investment objective of the organization, all the assets belonging to different classes will be diversified. Correct input is important as it influences the funded status of the plan and long term liability projection. Further, this will also affect the risk level associated with the plan. There is a need for general policy where investments and equity options are diversified along with fixed income securities (Hovey & Wysel, 2011). Once all of these are done, the total return balance can be estimated and any possibility of undue risk present in a particular class or asset investment can be eliminated. The support of organization in altering the model portfolio based on results is important to obtain a market view.

The operating ranges of asset allocation as has been established above is going to represent the long term perspective of the organisation operations. In this regard, there is going to be unanticipated market shift that eventually leads to the fall of asset allocation outside the varied operation ranges. In this regard, semi-annual allocations and targets are compared. In other words, portfolio achieves a balance based on operation range. The conditions that have been developed need to be justified by giving the exposure constraints picture. This understanding can help in developing a strategy for extended time and period and this proposal can be forwarded to the board for consent (Krishnamurti & Vishwanath, 2009).

GET ASSURED A++ GRADE IN EACH FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENT ORDER - ORDER FOR ORIGINALLY WRITTEN SOLUTIONS!

5. Tax Considerations

In this statement, tax consideration is very important. Yet, straight-forward nature is important. The reason is the possibility for variation of tax consideration based on the number of financial activities. This is however not limited to capital gains and income tax rates, issues due to weather transfer and long term holding of a specific asset. Although holding a few assets can be good as it can generate huge capital gains, it needs to be transparent.

Long term holding of a property tax is another subject of concern. Meanwhile, the sports organization can lookout for interests from new investors so that the accounts can be treated differently such as regular and tax retirement accounts. During this calculation, it is important for the firm to estimate the return (Krishnamurti & Vishwanath, 2009). Income remitted or taxes involved need to be taken into considered and added to the payment line item.

6. Time Horizon

Time horizon can be defined as the remaining years of life left for the organization to operate in the market. In this regard, the time will favour the organisation only in the event that there is an investor with a short or medium or long term horizon.

Short term is said to be below 3 years.

Long term implies a period of 5-15 years.

Looking at the durations mentioned, it is clear that the organization here is looking for a long term horizon. In addition to involving investor in this horizon, it is important to estimate if there are multiple stages of investors (Krishnamurti & Vishwanath, 2009). This is due to the presence of different time horizons in this event and that every stage is considered as a life event.

A case scenario can be defined as the situation when an athlete is left with 2 years as per the control. In this case, the first stage will be a short term of less than 2 years window. If athlete rethinks and confirms the continuation with organization, the second stage will be a period of 3-15 years. There is also a scope for 4th stage which extends even after the life of individual (Zhu, 2017). When an investor joins the firm, it is essential to identify these stages and discuss the objectives and length so that they understand the investment risk and confirm association.

NO PLAGIARISM POLICY - ORDER NEW FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENT & GET WELL WRITTEN SOLUTIONS DOCUMENTS WITH FREE TURNTIN REPORT!

7. Regulatory and Legal Considerations

We shall ensure straightforwardedness in the legal and regulatory requirements for this investment policy statement. Legal concerns will include stakeholder and athlete contracts. Whenever legal issues are not required, prudent investor rule will be applied. In general, the common issues faced will be flagged and these include trust and tax related issues, including a potential insider stock position (Zhu, 2017). In addition, when it comes to the organisation investment policy framework, the regulatory as well as legal questions will not be based on the fact that the organisation needs to come up with a differentiator in regard to risk tolerance between investors and institutions which have a legally binding liability, and trust/foundation that is mentioned is in regard to the prudent investor rule or one relevant to the organisation's policy statement. Other aspects will look at the issue associated with institutional statements of investment policy that are usually handy.

8. Unique Needs and Circumstances

This is the final section of the investment policy statement. The sports organization here will offer a list of items that are unique. One of them is client imposed constraint which is associated with the social responsibility of a portfolio. Sometimes, issues like decline to purchase firearm or other harmful substances are also considered (Röder & Walter, 2019). Such things will include steroid, harmful substance induced energy drinks, leisure items which do not belong to budget among other issues related to unique needs. Also special instructions given by the investors, desired bequests, assets that are not mentioned in investment portfolio and forbidden asset class will be considered as part of the unique needs and circumstances.

HELPING STUDENTS TO WRITE QUALITY FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENT AT LOW COST!

Part 2 - The sporting organisation is considering a mix of equity, debt and cash (or money market securities). You are asked to determine an asset allocation strategy by considering the current and future economic situations, government policy and monetary conditions. You are required to suggest a asset allocation strategy. For example a mix of 40% equity, 40% debt and 20% cash (and marketable securities) may be suitable for an organisation or an individual pursuing a balanced portfolio. Prepare an account of why the chosen asset allocation is appropriate for the local sporting organisation.

Answer - Asset Allocation

For the given organization, the asset allocation will also study the investment strategy to ensure proper division of investment portfolio across different types of asset classes. This is to mitigate the overall risk. Ideally, 3 categories of assets will be looked at - bond, stock and cash (Röder & Walter, 2019). Alternative assets are not considered.

Let us assume that this organization has a portfolio of $250,000

Duration of time horizon is 6 months

The organization portfolio categorizes them as 50% for stocks, 40% for bonds and 10% for cash. The allocation portfolio will look like below:

Equity

Small-Cap Growth Stocks - 25% ( 25/100 x 250,000) = $62,500

Large-Cap Value Stocks - 15% (15/100 X 250,000) = $37, 500

International stocks - 10% (10/100 X 250,000) = $25,000

= $125,000

Debt

Employee - 15% (15/100 X 250,000) = $37500

Business - 25% ( 25/100 x 250,000) = $62,500

= $100,000

Cash

Money market - 10% (10/100 X 250,000) = $25,000

= $25,000

The total amount for each allocation thus:

Equity = $125,000

Debt = $100,000

Cash = $ 25,000

= Total $250,000

GET READYMADE FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENT SOLUTIONS - 100% PLAGIARISM FREE WORK DOCUMENT AT NOMINAL CHARGES!

Part 3 - Having decided on a mix of asset allocation, you are now required to choose specific investments for equity and debt. You may give due consideration to possible diversification benefits when considering investments from different sectors or industries. You are required to prepare an explanatory statement as to why the specific investments (shares, bonds, etc.) are chosen, along with their nature and risks.

Answer - Equity and Debt investment allocation

Even though the equity and debt investment is good for this sports company as it will ensure productive results/returns, it is important to know how this process is carried out. The allocation procedure is mentioned as follows:

Equity

Small-Cap Growth Stocks - 25% ( 25/100 x 250,000) = $62,500

Large-Cap Value Stocks - 15% (15/100 X 250,000) = $37, 500

International stocks - 10% (10/100 X 250,000) = $25,000

= $125,000

Debt

Employee - 15% (15/100 X 250,000) = $37500

Business - 25% ( 25/100 x 250,000) = $62,500

= $100,000

Debt investments consider fixed payments, bonds, investor interests and mortgages. In most cases debt investments are more likely to be less risky when compared to the equity investments. However, there is a possibility for return to lower when compared to equity investment. Debt investments are also less volatile in relation to common stocks with very few areas of highs and lows in relation to the stock market.

Looking at the historical data, it is evident that bond market and mortgage shall undergo lower price changes against stock. When the corporation enters the state of liquidation, it is important to compensate the holders first (Röder & Walter, 2019). Investments in mortgages like remaining type of debt investment will often come with specific interests.

Looking at equity investments, organizations usually consider stock/security associated with asset/earning. This form of investment is advised when the returns are high but the losses can also be high. Stock is a volatile investment option and the share values usually fluctuate (Röder & Walter, 2019). This fluctuation is not due to solidity of organization but there are also governmental, social and political aspects that influence the performance. In this regard, in the equity investment the organisation will be taking a higher risk.

Part 4 - Prepare a report showing details of the above steps with timelines and tracking performance of your portfolio on a monthly basis, through the 6 months from 1 October, 2018 to 31 March, 2019.. You may compare the performance of your selected portfolio with the cash maximiser return, and any other relevant benchmarks. Offer relevant comments (e.g., if the portfolio underperforms, to highlight that performance normally needs to be compared over a longer time-frame than 6 months).

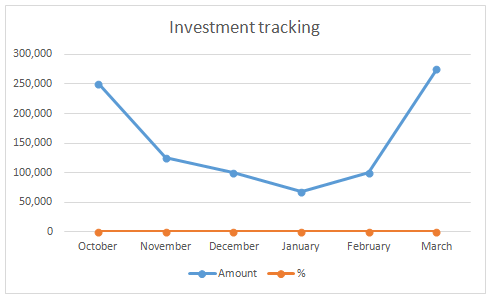

Answer - Portfolio performance tracker Model

|

Month

|

Amount

|

Gain Percentage

|

|

October

|

250,000

|

50

|

|

November

|

125,000

|

40

|

|

December

|

100,000

|

27

|

|

January

|

67,500

|

40

|

|

February

|

100,000

|

101

|

|

March

|

275,000

|

0

|

ENDLESS SUPPORT IN FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENTS WRITING SERVICES - YOU GET REVISED OR MODIFIED WORK TILL YOU ARE SATISFIED WITH OUR FIN201 INVESTMENT POLICY STATEMENT ASSIGNMENT HELP SERVICES!

Access our King's Own Institute, Australia Assignment Help Services for other various related courses such as: -

- FIN200 Corporate Financial Management Assignment Help

- FIN203 Banking and Finance Assignment Help

- FIN700 Financial Management Assignment Help

- FIN702 Investment and Portfolio Management Assignment Help

- ACC202 Management Accounting Assignment Help

- ACC203 Accounting Information Systems Assignment Help

- ACC204 Corporate Accounting and Reporting Assignment Help

- ACC300 Auditing and Assurance Services Assignment Help

- ACC301 Tax Law Assignment Help

- ACC101 Introduction to Financial Accounting Assignment Help

- ACC200 Introduction to Management Accounting Assignment Help

- ACC201 Financial Accounting and Reporting Assignment Help