Auditing Case Study, Kings Own Institute

ACC707 Auditing And Assurance

GET BENEFITTED WITH QUALITY AUDITING CASE STUDY ASSIGNMENT HELP SERVICE OF EXPERTSMINDS.COM!

Topic: Research, Critically Analyse And Evaluate Key Audit Matters In Independent Auditor's Report

Executive Summary: The report highlights ASA 701 key audit matters of Westpac Bank necessary for the betterment of its financial standards and forecasting about its future condition. Financial auditing is the is a process by which business organisations especially corporate banks examine their financial records to determine their accuracy, obedience and performance towards accounting and auditing rules and regulations. A significant change in Auditor Reporting standards is the latest Australian Standard on Auditing (ASA) ASA 701. The AUASB is an independent statutory committee of Australian Government under Section 227A of the Australian Securities and Investments Commissions Act 2001 (ASIC Act). Key Audit Matters is not suitable for providing modified opinions, the description of any audit matter provided in the Key Audit Matters section must contain reference related to disclosure, implied by the auditor as it is necessary for maintaining the authenticity of the audit report. The Auditing standard expresses that in auditor's report an auditor must involve all the statements of the company or organisation for which he is making the audit report and the auditing procedure must follow the 10 Accounting principles. The company enjoyed an overall growth which was significant for securing the economic condition of the company. Westpac Bank after reaching a secure position in the international market is still having some issues in their auditory and management department which must be immediately improved in order to gain significant economic control over the international economy. Westpac Bank has to stress and concentrate on their improvement in gaining the economic profit as it is gradually decreasing with time. Compared to 2014 the economic profit of the company has significantly decreased which is a major issue for the organisation. It can be estimated that the auditor after examining all the improvement areas must incorporate immediate steps for the betterment of the company and perform the needful at the earliest.

Question: Demonstrate their ability to research, critically analyse trends and issues in auditing and assurance services, identifying problems as would arise in a modern organisation.

Answer: Introduction: Auditing is a most important process which must followed by every business enterprise and especially banking sector. Auditing helps to avoid the risk of poor and fraud accounting and helps in forecasting financial benefits of a running business process including profit analysis and risk assessment. Auditing provides facility by providing even the profit margins and the process of acquiring the profit margins. This report revolves around ASA 701 key audit matters of Westpac Bank necessary for the betterment of its financial standards and forecasting about its future condition. The report also contains different audit data which are essential for evaluating about Westpac Bank's accounting and auditing standards while highlighting the annual report of the bank discussing its financial standards and Audit Committee Charter.

Findings and analysis: Financial auditing is the is a process by which business organisations especially corporate banks examine their financial records to determine their accuracy, obedience and performance towards accounting and auditing rules and regulations. According to Griffin and Wright (2015, p. 378), business enterprises organise audit planning procedures to develop audit plans necessary to execute strategies and planning related to financial and economic development of the organisations. Westpac Bank significantly managers its auditing group for forecasting about financial and sustainability in business management.

Key Auditing Matters : A significant change in Auditor Reporting standards is the latest Australian Standard on Auditing (ASA) ASA 701. The AUASB is an independent statutory committee of Australian Government under Section 227A of the Australian Securities and Investments Commissions Act 2001 (ASIC Act). According to the Corporation Act 2001, under Section 336, Auditing Standards are essential for the purposes of Corporations Legislation. The key features of this are:

• Mandating the communication of Key Audit Measures (KAM) in auditor's report

• Determining the management judgements and effects of significant events of Key Audit Measures (KAM) (based on the views of Masli, Porter and Scholz, 2018, p.189)

• The auditor of a particular company describes individual Key Audit Measures (KAM)

• The auditor provides information of audit documentation requirements related to Key Audit Measures (KAM) (as influenced by the views of Manganaris, Spathis and Dasilas 2015, p.79)

• Decisions taken whether to implement Key Audit Measures (KAM) in the audit report

ORDER NEW AUDITING CASE STUDY ASSIGNMENT AND GET 100% ORIGINAL SOLUTION AND QUALITY WRITTEN CONTENTS IN WELL FORMATS AND PROPER REFERENCING!

ASA 701 is an auditing standard which helps the auditor to determine key audit matters and forming an opinion on the financial report of a specific organisation in this case Westpac Bank and communicates that financial information in order to maintain sustainability of the organisation and forecast if any risk approaches. According to the ASA 702 standard of the auditing methods the auditor of Westpac bank must determine the matters which are communicated rather than those matters which needs significant attention of auditor for performing audit. According to Para A9-A18, the auditor of Westpac Bank or any other organisation must consider certain factors tremendously significant for the process of auditing which are:

• Companies or organisations could consider to follow ASA 315 (Para A19-A22) to consider areas of higher assessed risk related to material misstatement or avoid significant risks.

• Following the Para A23-A24, of ASA 701 the auditors can provide correct judgemental decisions to the areas of the financial report including making estimations of budget planning which can have high estimation uncertainty.

• According to Para A25-A26, the auditor of the companies or organisations has to significantly concentrate and analyse the effect of their auditing in important events or financial transactions of the company during a certain period.

Again it is also mentioned in ASA 701 Para A9-A11 and A27-A30 that auditor can stress on determining paragraph 9 of the Auditing Standard which were most significant in the audits of the current period financial reports therefore are the key audit matters of ASA 701.

The auditor can make a separate heading of "Key Audit Matters" and analyse each key audit matter of the companies or organisations and provide a proper introduction to the audit report which must consist of:

• Description of Key Audit Matters section which is the description of auditor's professional judgement which is considered as the most significant element of the audit report as the total financial forecasting is done by the auditor in avoiding risks and material misconceptions (Based on the views of Çanakoglu, Muter and Adanur 2018, p.503).

• The whole audit report must contain matters in forming auditor's opinion in overall audit report as a whole and the auditor must not provide any opinion thereon as the auditor does not provide any other separate opinion on these matters. (A31-A33)

According to Para A34-A51 of ASA 705 Key Audit Matters is not suitable for providing modified opinions, the description of any audit matter provided in the Key Audit Matters section must contain reference related to disclosure, implied by the auditor as it is necessary for maintaining the authenticity of the audit report. The financial report can choose to address the significance and importance of the audit report for being in Key Audit Matters section and express the procedure of describing the process of matter addressing.

According to Para A53 and A56 the auditor must exclaim about Law and Regulation of Australian auditing precluding public disclosure. The auditor in this case of public addressing can conceal some information in the auditor's report for overweighting of public interest benefits in having excessive communication of the auditor's report (As opined by Ghosh, Jarva and Ryan 2018).

The auditor's report must contain interaction between descriptions of the Key Audit Matters and other elements and stresses about involvement of these elements in Auditor's report. In accordance with ASA 705 a material related to events or conditions which express doubts on the ability of the entity to continue in gaining concerns for Auditing Matters section of the Auditors Report. The report must contain references on the basis of qualified opinions or material uncertainties related to Going Concern sections in Key Audit Matters Section.

Lastly it is the auditor's duty to form content related to auditing methods of companies or organisations and according to paragraph 15 of the Auditing standards the auditor must include separate statements in separate sections in the auditor's report under the heading of "Key Audit Matters"

Key audit matters in Westpac Bank: In order to analyse the financial condition of Westpac Bank and its Key Audit Matters discussions must be made related to its financial performance in 2018. Analysing the financial performance of the company economic development of the company by auditing, methods can be evaluated. This corporate bank has a tremendous brand name in Australian Market as well as the global corporate banking industry. Cash earnings of the company ended in 30th September of 2018 which amounted in $8065 which was tremendous and the company experienced a 3 million hike than the financial report of 2017. At the end of the 2018 it was analysed that the total amount collected by the company was $8098 which proved sustainable growth of the company and secured financial grounds. Needless to say, that the financial auditor expertly managed the risk assessments and problem s of material misplacements which was tremendous achievement of the company.

Westpac Bank significantly follows the ASA 701 with full potential for avoiding risk assessments which are effective in regulating rules and regulations of the company. The chief auditor of Westpac Bank sticked to the "Key Audit Matters" which were essential for maintaining steady growth of the company's financial growth of the bank in 2018. The auditor of the Westpac bank significantly followed the principle of ASA 702 and maintained keen observation about financial risk assessments and material misplacements according to ASA 315. A25-A26 of ASA 701 followed by the Westpac Bank clearly states that the auditor is responsible for making any judgemental decisions including making financial estimates and budget planning necessary for the company. The auditors of Westpac Bank must consider taking necessary actions to foreseek any financial risk and regulating the results in order to maintain sustainability in business management.

NEVER BE CAUGHT IN PLAGIARISM, AVAIL AUDITING CASE STUDY ASSIGNMENT HELP SERVICE OF EXPERTSMINDS.COM AND SAVE HIGHER MARKS!

The auditor of Westpac Bank according to Para A9-A11 and A27-A30 of ASA 701 concentrates to maintain sustainability in business process by analysing the previous year's financial data in order to understand and evaluate the possible future financial risks which the auditor needs to avoid for Westpac Bank. The auditor's decision is considered to be the ultimatum in making financial judgement in the audit report which is essential for Westpac Bank to maintain. Westpac Bank According to Para A34-A51 of ASA 705 includes reference to the audit report to maintain the authenticity of the audit report related to disclosure. The Auditor of the Westpac Bank significantly manages to obey the law and regulation of the auditing rules of Australia in securing the financial status of the company. Westpac in drafting Key Audit Measures (KAM) must regulate auditor's report in maintaining authenticity of the audit report in concealing some data information necessary for public interest benefits. Westpac Bank significantly manages about the mandating of communication of Key Audit Measures (KAM) and assessing risk measures which are essential for audit manager to maintain for boosting Westpac Bank's financial profit gain and securing the bank's economic stability in the global money market. Westpac Bank thus under ASA 705 maintaining and obeys all the necessary steps for maintaining the authenticity and stick to the Australian Securities and Investments Commissions Act 2001 (ASIC Act) and stays true to the Australian Law.

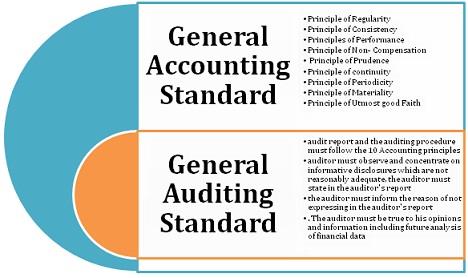

Accounting and auditing standards

General Accounting Standard: General Accounting Standard is meant to ensure a minimum level of consistency in a company's financial or economic statements and conditions which helps the investors to analyse the information easily without any hazard. There are 10 principles on which the accounting standards remain. Principle of Regularity is the state on which accountant adhered to the GAAP rules and regulations as a standard. Principle of Consistency is where a professional commits to same standards of procedures throughout the audit reporting process to prevent errors or disparity. As per the views of Medina et al. (2016, p.26) accountants are expected to provide an overall presentation of the accounting process and explain reasons for any change or update of financial figures. Principles of Performance of Methods produces the significance of consistency of procedures used in financial reporting.

Principle of Non- Compensation signifies of both positive and the negative impacts for the report and without expecting debt compensation. According to Saltaji, Croitoru and Aly (2017, p.45) Principle of Prudence emphasizes on fact based financial data representation which is not clouded by speculation. Principle of continuity states about continuing of business process while valuing its assets. Principle of Periodicity provides information for distributing all entries in appropriate period of time. Principle of Materiality states that the accountants involved in performing financial reports must strive for the report's full disclosure. Lastly there is Principle of Utmost good Faith which suggests that the parties involved in business process must be honest to each other and the accounting report provided to the company must be authentic and true to the financial data structure.

General Auditing Standard: The Auditing standard expresses that in auditor's report an auditor must involve all the statements of the company or organisation for which he is making the audit report and the auditing procedure must follow the 10 Accounting principles. According to Attwall, Williams and Perry (2017, p.39), the auditor must identify in auditor's report the circumstances in which such principles have not been constantly examined in the present period of time in relation to the preceding period. As influenced by the views of Robertson (2018, p.31), it can be stated that the auditor must observe and concentrate on informative disclosures which are not reasonably adequate, the auditor must state in the auditor's report. It is the duty of the auditor to significantly analyse auditing information and take the decision of presenting it in the auditor's report. Zhang (2017, p.149) opined that, at times when the auditor cannot establish any particular, the auditor must inform the reason of not expressing in the auditor's report. The auditor must be true to his opinions and information including future analysis of financial data as the total financial condition of the company or organisation depends on the auditors and their company analysis.

Figure: 1. Accounting and auditing standards

ENDLESS SUPPORT IN AUDITING ASSIGNMENTS WRITING SERVICES - YOU GET REVISED OR MODIFIED WORK TILL YOU ARE SATISFIED WITH OUR AUDITING CASE STUDY ASSIGNMENT HELP SERVICES!

Financial Data Analysis of Westpac bank: Westpac is hiking its sales tremendously based on its audit performance, the company notched up $2.04 billion in cash earnings during the last three months of 2018. The company enjoyed a pleasant rise of 6.8% quarterly increase in unaudited cash earnings. Cash earnings of the company which was $8062, million in 2017 hiked to $8065 million in 2018 which is a significant rise and an overall development of the bank is in order can be understood. Analysing the sales earning of the company it was observed that the cash earning of the company was merely $7628 million which portrays significant rise in the company's financial upliftment and betterment in terms of securing the economic grounds of the company. The net profit of Westpac Bank was 2% increase in net operating income before operating expenses (Refer to Appendix).

The company enjoyed an overall growth which was significant for securing the economic condition of the company. The company experienced a net income of $16505 million dollars which was an enormous amount supported by an increase of 989 million or 6% increase in 2018 compared to 2017. Noninterest income of the company of $5628 million faced a decrease of $658 million or 10% compared to the rate of 2017. The economic profit of the company however experienced a decrease as in 2018 is $3444 million which was $3774 million in 2017. It is seen that the economic profit of the company is experiencing a significant loss as Westpac Bank in 2014 has a significant economic profit of $4497 million. The cash earnings in per Westpac share value has a rate of 2.36% which became 0.4% low from the previous year. Depending on this condition it can be stated that Westpac Bank has successively performed well in its aspects and has been able to secure its financial grounds based on the auditory forecasts made by the audit manager.

Recommendations and conclusion: After examining the loss stricken areas of Westpac Bank certain recommendations must be given to the company for its betterment in the economic grounds. Westpac Bank after reaching a secure position in the international market is still having some issues in their auditory and management department which must be immediately improved in order to gain significant economic control over the international economy. Westpac Bank has to stress and concentrate on their improvement in gaining the economic profit as it is gradually decreasing with time. Compared to 2014 the economic profit of the company has significantly decreased which is a major issue for the organisation. The auditor of the Westpac Bank must input tremendous amount of stress which is essential for improving the economic condition of Westpac Bank. Auditor must concentrate on Accounting principles and Auditing strategies which will take out the company from its painstaking position in economic field of profit gathering. There are various other problems included which are essential for the auditor to eradicate in the next year audit as it is essential to increase the Westpac Bank per share value and increment of share percentage.

Thus it can be concluded that Westpac Bank inspite of certain losses in the economic field is gaining an increment in profit margin from its previous years indicating the significant forecasting power of the auditor. It can be estimated that the auditor after examining all the improvement areas must incorporate immediate steps for the betterment of the company and perform the needful at the earliest.

Listed below some of the major courses cover under our Kings Own Institute, Australia Assignment Help Service, such as:

- ACC701 Financial Accounting Assignment Help

- ACC702 Managerial Accounting Assignment Help

- ACC204 Corporate Accounting and Reporting Assignment Help

- ACC300 Auditing and Assurance Services Assignment Help

- ACC700 Principles of Accounting Assignment Help

- ACC100 Introduction to Accounting Assignment Help

- ACC201 Financial Accounting and Reporting Assignment Help

- ACC303 Contemporary Issues in Accounting Assignment Help

- ACC707 Auditing and Assurance Assignment Help

- ACC708 Taxation Law Assignment Help