Asset Analysis

HI5002 Finance for Business - Holmes Institute, Australia

Company Performance Analysis - Abundant Produce limited

DO YOU WANT TO EXCEL IN ASSET ANALYSIS ASSIGNMENT – ORDER AT EXPERTSMINDS!

Abstract: In the abstract, the Group "Bigshot" is going to do the financial ratio analysis to get their current and long term performance of the company, by expending their profitable product range named as Abundant health products to get acomparative advantage and maintain its market position. In this paper, there is an identification of the liquidity and capital ratio of the company that which kind of system they are using to enhance their operation and profits. Thefinancial ratios from 2016-2017, 2017-2018, and 2018-2019 are also analyzed to make an effective decision regarding investment. This is an informative approach to understand what kind of increments and fluctuations are there in these years.

After the analysis of these ratios, there is also a discussion regarding the non-current assets of the company and the depreciation methods for fixed assets over these periods. There is also an analysis regarding the operating cash flows and long term assets of the company from its financial position of 2016 to 2019 that what their operations are either increasing or decreasing. The given scenario is critically analyzed for the project in the worst and thebest case of a project. The group will discuss the latest shares and bonds of the company and its effects.The price earnings ratio and share price of the "Abundant Produce Limited" for the last three years shows the great fluctuation of the values. After all the analysis, it comes to the point that this is a quite risky project according to the current position of a company, but there is a maximum percentage of chances to earn a profit in the future years.

Introduction: In the introduction, our group named as "Bigshot" is going to select one company which is listed is Australian Stock exchange (ASX). An investor from overseas is interested in investing in the Australian market, and the group is going to give financial advice to the investor. After choosing the company from ASX, the group take the financial reports of 2016 to 2019 for the financial analysis (Abundant Produce Limited, 2018).

The company which is selected for investment is named as Abundant Produce limited from the listed companies in Australia. After choosing the company, the purpose of this paper is to give the complete financial analysis of the company overall for checking the performance of the company to give the overseas investor a project for investment. This paper is informative to describe the idea of expansion of its one product of the company and tell the importance of that product which is gaininga competitive advantage in the market.

After the product analysis, our "Bigshot" group is going to do a comprehensive analysis of the financial ratios from the company's annual reports from 2016 to 2019. These ratios include liquidity ratios and capital structure of the company. After that, the group is going to do the non- current analysis of the company which include long term assets, also discuss the depreciation method that is applied by the company and discussed how the company treat the depreciation for the identification of the operating cash flows also involved the purchase of long term assets (Abundant Produce Limited, 2016).

After the Ratio analysis, there is a critical evaluation of the scenario-based calculation of the company's data provided. In this scenario, the company is going to launch a product and purchase the equipment. After this, there is an identification of the latest share and issuance of the bond of the company and its effect on the capital structure.

WORK TOGETHER WITH EXPERTSMIND’S TUTOR TO ACHIEVE SUCCESS IN ASSET ANALYSIS ASSIGNMENT!

Question 1: Description of one key product or service offered by the selected company.

Answer: Key product and service: In the key product of the "Abundant Produce Limited Company", the abundant natural health product is providing the customer to the skincare and body care products from greenhouse vegetables and minerals that in incorporated with active botanicals extracted - these materials derived from the pure and natural Australian Resources for producing the product. The company is getting a comparative advantage from selling these products from many years (Linked in, 2019).

The company specialized in giving health care products to its customers. The importance of these products and services are, the customers use natural health care products and to avoid chemical products. For using these products and services, the customers get secure and trustful in the company's product. The company's overall products based on natural resources that are used by the company for producing their products.

Question 2: Identify and conduct a trend analysis with two groups of financial ratios, including liquidity and capital structure of the selected company.

Answer: Financial Ratio analysis: In the ratio analysis, the data is collected from the annual reports of the company to evaluate the performance of its liquidity and capital structure.

|

Ratio's

|

2016(%)

|

2017(%)

|

2018(%)

|

2019(%)

|

|

Current Ratio

|

8.08

|

4.92

|

10.24

|

9.21

|

|

Gross profit Ratio

|

92.7

|

0.0043

|

75.5

|

68.87

|

|

Inventory ratio

|

4.27

|

3.44

|

1.55

|

3.05

|

|

Debt to equity

|

0.00491

|

0

|

0.041

|

0.78

|

In the current ratio of 2016 to 2019, the value of the current ratio is fluctuating, but the highest was in 2018. The current ratio shows the current assets are greater than the current liability of the company. In the gross profit ratio, the lower cost of goods sold,which results in higher the gross profit. In 2016, the gross profit was higher, but it gets lower in 2017 and 2018 but again recovers in 2019 which means that cost of goods sold is lower in 2019. In the inventory ratio, when the net sales are higher, the inventory ratio will be considered as good. In 2016, the inventory ratio was higher but decreased in 2017 and 2018. In 2019 it recovers and high with 3.05%, which means the sales are getting higher in 2019.

In debt to equity ratio, when the debt is higher from the equity, the ratio will higher. That's why this ratio must lower. In 2016, the ratio was high, but in 2017 the ratio is getting lower with time the debt to equity ratio is increasing (Abundant Produce Limited, 2017). The company is getting more debt because they are in a state of enhancing its product line to get more profit. In 2019, the debt to equity ratio is higher. The company starts to issue its bond and getting the debt to enhance their operations. They are going to use the leverage system, which magnifier their sales and increase the net profits. The leasing system used for applying the magnifier effect on the investment means to get abnormal profit after getting debt.

Question 3: Perform a non-current asset analysis.

Answer: Non-Current Asset & Depreciation Analysis: In the non-current current asset, in 2016, the total non-current assets of the company are $1401953. In 2017, the total non-current assets of the company were $1096206. In 2018, the total non-current assets of the company were $815540, and in 2019, the total non-current assets of the company are $47958 (Abundant Produce Limited, 2019). After seeing the value of the non-current assets is decreasing, which means there is fluctuation in the long term assets of the company. The reason behind the lower non-current assets is the company didn't purchase the long term equipment's throughout the years.

In the depreciation analysis, the company is using the straight-line depreciation method for the companies fixed assets that include their buildings and leasing capital assets. But they exclude the freehold hands. But the assets that are holding on lease are depreciated for the short period or unexpired period for the improvements in their useful lives. The company used 33% depreciation for the company's fixed assets include buildings and its improvements, office and computer equipment and fermented plants.

The cash flow from operating activities of the last three years isincreasing. The operating cash flow of 2017 is 1158880, of 2018 is 1307230 and of 2019 is 1727627. The operating cash flows show that the business is expanding over the three years in the financial performance of the company. The company is focusing on the short term assets are projects and didn't focus on the long term projects, that's why the company's operations are increasing day by day, but their long term assets are decreasing.

EXPERTSMINDS.COM ACCEPTS INSTANT AND SHORT DEADLINES ORDER FOR ASSET ANALYSIS ASSIGNMENT – ORDER TODAY FOR EXCELLENCE!

Question 4: Perform a scenario analysis with data provided.

Answer: Scenario-Based Analysis: According to the scenario the Abundant company is considering the new project with new product ad expected to sell for an average price $25 per unit and sell 450,000 units per year at this price for four years. The company purchased the equipment for $2,500,000 and have residual value in four years of $500,000 with working capital $800,000. Like the above scenario, the NPV of the assumed product can be calculated:

NPV = ∑ Net period cash flows / (1 + discount rate) ^ n - initial investment

NPV = $45,000,000 / (1 + 0.12) ^ 4 - ($2,500,000 + $800,000)

NPV Baseline = $25,289,580

According to the above two different scenarios's the best and the worse scenario, the sensitivity of the NPV of the product can be calculated as:

Sensitivity of NPV of the product = % change in output / %change in input

Worst condition

|

After 4 years ($)

|

|

Sales 20% decrease, unit price decrease by 20% per unit

|

28,800,000

|

|

Total variable cost 20% increase

|

-32,400,000

|

|

Fixed cost increase by $100,000 each year

|

-2,200,000

|

|

Incl. Depreciation expense

|

500,000

|

|

Earnings before tax

|

-1,400,000

|

|

Tax expense 30%

|

(420,000)

|

|

Net income

|

-980,000

|

|

Net Cash flow

|

-480,000

|

|

Discount net cash flow

|

-$305,050

|

Discount net cash flow = - 480,000 / (1 + 0.12) ^ 4

Discount net cash flow = -$305,050

NPV = net cash flow - initial investment

NPV = -$305,050 - $25,289,580

NPV = - $25,594,630

Change in NPV of the product = Change in output / Change in input

% Change in NPV of the product = - $25,594,630- $25,289,580 / - $25,289,580

% Change in NPV of the product = - $50,884,210 / - $25,289,580

% Change in NPV of the product = 2.01*100 = (201%)

Best Condition

|

After 4 years ($)

|

|

Sales 20%increase, unit price increase by 20% per unit

|

64,800,000

|

|

Total variable cost 20%decrease

|

(21,600,000)

|

|

Fixed cost decrease by $100,000 each year

|

(1,400,000)

|

|

Incl. Depreciation expense

|

500,000

|

|

Earnings before tax

|

41,800,000

|

|

Tax expense 30%

|

(12,540,000)

|

|

Net income

|

29,260,000

|

|

Net Cash flow

|

29,760,000

|

|

Discount net cash flow

|

$18,913,022

|

Discount net cash flow = $29,760,000/ (1 + 0.12) ^ 4

Discount net cash flow = $18,913,022

NPV = net cash flow - initial investment

NPV = $18,913,022- $25,289,580

NPV = -$6,376,557

Change in NPV of the product = change in output / change in input

% Change in NPV of the product = -$6,376,557 - $25,289,580 /- $25,289,580

% Change in NPV of the product = 1.25*100 = 125%

According to the above analysis, if the company launch new product then this product have different cash flows in different scenarios. If the worst scenario the product cash flow more fluctuate from its baseline NPV. The NPV of the product is more sensitive in worst scenario.

In the best scenario. If the sales increases, and the variable and fixed cost decreases, then there is less fluctuation in the product as compare to worst condition. The change in cash flow of the new product is less than the change in cash flow of the worst condition (Smirnov, 2029).

GET GUARANTEED SATISFACTION OR MONEY BACK UNDER ASSET ANALYSIS ASSIGNMENT HELP SERVICES OF EXPERTSMINDS.COM – ORDER TODAY NEW COPY OF THIS ASSIGNMENT!

Question 5: Identify and discuss any latest share or bond issuance by the selected company.

Answer: Latest shares and Bond Issuance: The Abundant Company issued 5,750,000 shares on August 13, 2019, and the raising amount of the shares is $345,000. The company's shareholders approved the shares 17,499,999 in the extraordinary meeting on 21 August 2019 to the directors, and the rising amount of these shares is $1,050,000 the shareholders of the company approved 5,000,000 shares at the 6 cents per shares. The company issued the shares for public offering. The BOD and shareholders are the undertakers of these issue shares, and these shares affect the company financial statement in futures. These shares affect the company operations group. These operations will affect the company capital structure in the future financial statement.

Question 6: Calculate and discuss the PE ratios and share price movement of the selected company through 3 years.

Answer: PE Ratio and Share Price Movement for three years: The Price-earnings ratio fluctuates from the year 2016 to 209. In 2016, PE ratio was less 1.44 which is less but then increase rapidly in the next year, and the value raises to 5.66 in 2017. Then in 2018, the ratio value decrease to 3.5 and in 2019 the RE ratio value is 3.9, so, there is variation in the values of PE ratio. In the same way, the earning per share (EPS) values also vary from the year 2016 to 2019. In 2016, the EPS value was 0.09, and then it decreases in the year 2017 which is 0.03 (Australia Stock Exchange, 2019).

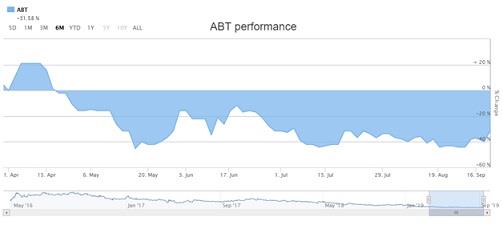

Then the EPS value of the company increase due to greater outcome from its shareholders. Its value in 2018 is 1861341, and in 2019 the company obtain greater profit from its shareholders which is 3037272. So, the value of EPS increases with time. Likewise there is also changings in the value of its share. The value of market share increase in 2016 then decreases, and the value again rises in the year 2019.s, the share price changes within this duration. It can also be shown in the graph

Figure 1: Overall Share Performance of ABT

Recommendation: As the financial consultant, after analysis of three years financial performance of the company, it has come to knowledge the company have main focus on the short term goals. The company believe the short term profitability that helps the company to meet its obligation. As the company perform well in 2016 but with time the company expenses and liabilities increases. The company initially did not focus on long term goals. Therefore, the company revenue decreased with the passage of the time.

The company is focusing on the long-term objectives by launching the new health product in the market. The company paid more to shareholders for higher return in future. Therefore, I recommend that the investors must have to invest in a listed company named as Abundant Produce Company. It is because the company paid more to shareholders. The company also gain more revenue in future due to the new products launching.

The company now focuses on the Health Natural Product that has completive advantages in the Australian market and the company also need the capital for investing. Therefore, this company is the best option for investing. The company also paid a higher return to its shareholders. Through investing in this company, the investor gains more advantages due to the new products and the investor's value in front of the company (Simplywall, 2019).

24/7 AVAILABILITY OF TRUSTED ASSET ANALYSIS ASSIGNMENT WRITERS! ORDER ASSIGNMENTS FOR BETTER RESULTS!

Conclusion: The Abundant Produce Company is the hybrid plant breeder as well as the producer of the food crops and greenhouse vegetables that produces in the non-ideal condition. The company is the listed company that grow well in the Australian market. This company have natural health products that have competitive advantages in the Australian market. The company paid more to the shareholders and believed on the short term goals. Therefore the company financial condition affected in previous three years. Therefore, the company should issues bonds and shares to the shareholders to increase the equity of the company. The company now launch these health mediation products like pain relief products, migraine and headache products for increasing the more revenue from these strong products. The company now focuses on the long term planning for covering its liabilities and tax expenses. Through these steps the company can establish its strong position in the market.

Access Excellent Online Holmes Institute, Australia Assignment Help Services For Its Related Courses, Such As:

- HI6027 Business and Corporate Law Assignment Help

- HA2042 Accounting Information Systems Assignment Help

- HI5017 Managerial Accounting Assignment Help

- HI6006 Competitive Strategy Assignment Help

- HI6006 Key Strategy Development Tools Assignment Help

- HI6007 Statistics for Business Decisions Assignment Help

- HI5003 Economics for Business Assignment Help