HC1072 Economics and International Trade Assignment Help

Economics and International Trade

Purpose of the assessment (with ULO Mapping)

Students are required to work in groups to choose an industry then apply their knowledge in the unit to write an industry report (Learning Outcomes 1, 2, 3, 5). See Assignment Specifications for detailed requirementsDetailed requirements of the assignment

Organize yourselves into groups of 4 or 5 students and give your group details to your lecturer(s) no later than Week 6 (for Normal Mode) or Week 4 (For Block Mode 1) and Week 8 (for Block Mode 2). Late submission of group member list can result in your being unable to submit the group assignment and awarded a mark of zero for the group assignment.

Find a recent news article discussing a change in market condition(s) of an industry in 2018-2019, for example an observed change in market supply of a good/service or a change in consumers' taste and preferences for a good/service. The industry must be ONE of the following in Australia:

- Agriculture production

- Property market

- Mining industry

Using theories of economics, such as the demand and supply model and determinants of demand and supply, explain the impacts of changing market conditions on the price and quantity of goods or services traded. Support your analysis with market data.

No Plagiarism Policy – Order New Economics and International Trade Assignment & Solution! Get Well Written Solutions Documents with Free Turnitin Report!

Economics and International Trade

Introduction

Australian Property Market has been among those which has been kept under record by the majority of the people or citizens as compared to any other country. The reason for the same has been the fluctuations and the unexpected decisions taken in the market. Australia has been experiencing the fluctuations due to multiple reasons which marls the most important one to be the shift in the population within the country. The report explores the Australian Property market completely and it also specifies the background it had which helps in understanding the base or the actual cause of the current situation of the market. The country has witnessed multiple causes for the fluctuations be it economic, social or environmental. The economic factor has been the most important and impactful one and this would be explored thoroughly through the report (SmartCompany, 2019). The economic perspective of the analysis would help in understanding the contribution of the property market to the economic development of the country too. This would be a significant result of the analysis. The property market deals with the trade of land and its permanent fixtures within the boundary of the country. Concerning the Australian Property market the average price has a record of growing by 0.5% per year from 1890-1990 after inflation but during 1990-2017 a faster pace was held and this impacted the economy to contract its bubble. The analysis of the Australian property market would be provided through a background analysis stating the services and products that it dealt in, then the intensity of competition and the market structure it followed. The changes in the market conditions would be explored in concern of the current position of the market and the impact it has on the entire economy through the demand and supply perspectives.

Market Description

Australian economy is considered to be among the strongest economies because even after facing some great issues of property market and other industries, the economy has not been impacted to a great extent. As the sign of a strong economy is that the impact of the changes in the economic factor is not much intense on it, so has been experienced in Australia (Farrer, 2019). Though the property market of the country has been disturbed for few years, the economy of the country has not been falling or decreasing at a faster pace.

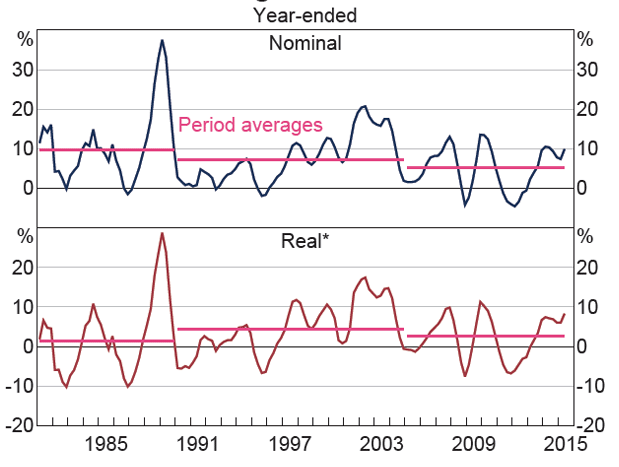

Figure 1: Demand of Property Market in Australia from 1985-2015

(Source: Au.finance.yahoo.com, 2019)

The products and the services of the property market has been to the residential properties majorly along with the official and industrial deals. It was observed and marked in the year 2011 that 8.6m households had an average size of households of 2.6 persons per household. The stand alone houses or buildings have been traditionally comprised of most building approvals, but as per the recent data a trend of higher density housing has been developed which includes townhouses and units. Turnover rates vary across market cycles, but typically average 6% per year (Zhang et al. 2015). The housing sector of the market has been the major factor and it has been impacting the property market to great extent. The housing sector has been the major factor which took place due to the immigration exercised in the country. It was observed in the late 2000s, that the housing prices in the country relative to average income was among the highest in the world. The affordability issue was also identified through the Foreign Direct Investment, as the years witnessed high capital inflows from Chinese investors. The immigration to the capital cities and developed cities has been impacting the property market at large and thus, the competition has also been impacted through it. Since the mid-1990s which marked the growth of immigration, the demand of the property market has been increased, specifically in the cities like Sydney and Melbourne. The credit line has been relaxed for temporary residents through allowing them to buy the property at 10% deposit.

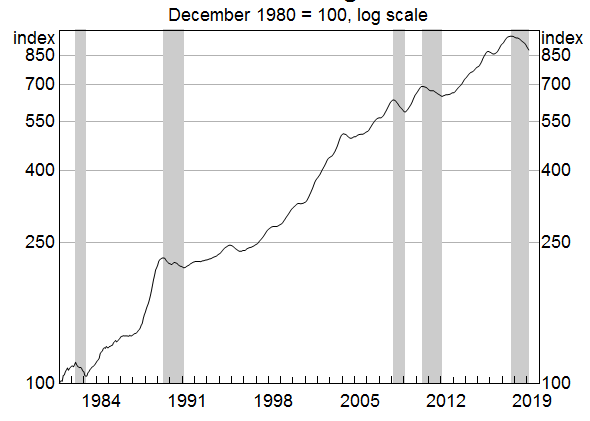

Figure 2: Australia Housing Prices

(Source: Guide, 2019)

The market structure of the property market has been observed to be competitive from the beginning of 1990s and it has been continuously on the growing trend. The market structure of property market being competitive in nature due to the increased demand has been experienced at different intensity in different cities of the country. Australia has a diverse outlook in the property market in its different states (Crabtree et al. 2019). The last six to seven years, the country has witnessed nationwide housing prices to be increased by 50%. Since then, prices have fallen by 9 per cent, bringing them back to their level in mid-2016.

Changes in Property Market Conditions and its Impacts

On considering the economic analysis of the property market of Australia, it could be rightly said that no economy sustains at the same pace or level for a longer period of time and this has also been experienced in the country. The property market of the country has been growing its contribution to the economy by an average of 3.4% per year which is quite a satisfactory figure. The divergent feature of the market that is the different rates in different cities has been quite unique in its appearance and this conveyed that the recent increase in the prices over the years has been pronounced over Sydney and Melbourne and so it is applied during the downfall too (Hughes and Lucas, 2016). The change in the Gross Domestic Product of the country has been impacting the property market too and in the recent quarter the growth has been the slowest growth which expanded just by 1.4%. The cities like Darwin and Perth has been weak due to the swings in the population and income associated with the mining boom. The increase in the prices has attracted the people with a perspective that capital gains would be experienced. But the valuations has been stretched which has been impacting the demand and it tailed off which shifted the momentum. During the fall in prices, the prospect of capital loss delays the purchase. The first home owners has been finding it comfortable to buy a house, the investors has been returning back to the market and the trading buyers has taken the opportunity to accelerate the buying activity of which they have always desired. These shifts in sentiment and momentum are seen in most housing cycles, but their precise timing is difficult to predict (Ley, 2017). Some analysts and authors has been carrying a view that the fluctuations in the market has been experienced due to national unemployment or interest rate factors but it has been acknowledged that in New South Wales which has witnessed a downfall in the property pricing, the unemployment rate has been continuously on an increasing trend. The main factors which has been responsible for the change in the property market position in the country has been the inflexibility in the supply side with the large shifts in the population growth.

The growth of Australia's population accelerated in the mid-2000s and it worked on the rate of property building and responded to it. The procedure for providing the required property took time for executing the activities such as arranging finance, council approvals, and plan and construct it. This was accompanied by the increase in the prices which was quite natural and applicable. With the supply response, the dwelling in Australia increased with an increasing rate in not more than two decades. The response was experienced through this extra supply too. Thus, it could be said that the economy has been responding within its laws and no extra natural reactions were experienced (Wong, 2017). The population growth and the supply dynamics has been most evident in the two states of Australia that is New South Wales and Western Australia. The mining investment also played a vital factor and during its boom the growth rate of population in Western Australia grew by 1% to 3.5% which marked a huge change. The response was controlled or checked through slowing down the construction of properties. When finally the response was recieved, the popoulation growth slowed down significantly due to the migration of the workers to the east by the end of the boom. Similar scenario was experienced in New South Wales, and the recent rate of construction has been marked to be the highest in decades. The population growth has moderated due to the immigration to other cities too as the prices of the property has been lower and cheaper in the other parts of the country.

On the demand side, the rise in the prices and then the decline has been influencing the prices. The Foreign Investment Review Board has also provided a major factor for analysing the impact of the change in the property market. China has been the accelerator in the property market, specifically in the housing market, during the downfall of the market, which added on to the foreign investments. The strong demand in the cities of Australia like Melbourne and Sydney attracted the investment in large. The source of demand was waned partly because of the capital inflows through China and other countries (Bright et al. 2015). The foreign demand added on to the domestic demand and the shift in the demand has been quite huge. The analysis of the impact of these additional demands has been providing an idea but not accurate information on the impact on the country's demand. This is due to the fact that the international developers was also observed to add on to the supply in Australia during the intense demand. The domestic investors has also been providing with attractive figures to add on to the supply.

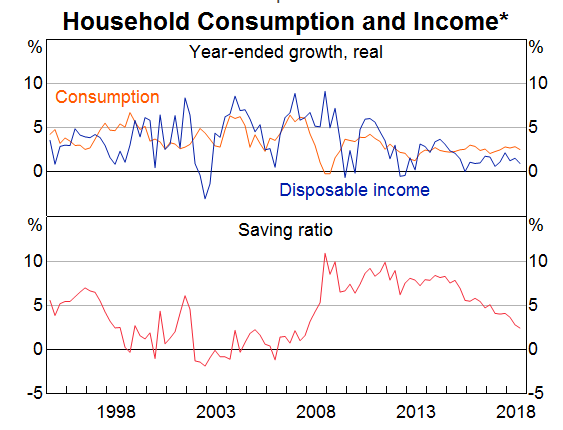

Figure 3: Consumption Capability of Australians

(Source: Martin, 2018)

The interest rates has been low and the tax structure has also been in favour of the investors which added on to the supply of investment on appreciating assets. This had a strong positive outlook, as the positive investment or the increasing investment has been providing a path for meeting the demands of the property market. But on consideration on the supply rigidity, along with the investor's desire to benefit from an increasing market accompanied by a low interest rate market, amplified the increase in prices. The acknowledgement of the combination of high prices with that of weak growth in rents revealed that the return from the rents has been quite low and this shifted the momentum. The acceleration in prices, along with the increase in the supply helped in achieving a stable momentum. The low interest rate has been quite in favour of the market and it added on to the demand as the low interest rate added on to the people' capacity to borrow which accelerated the purchase of appreciating assets (Cardew, 2017). The impact of fluctuations has been on the factors such as consumer spending, construction activities, finances and profitability of the organisations.

Conclusion

Australian Property Market has undergone wide fluctuations and it has been impacting the economy too, but the accurate and specific understanding of the cause and the impact of the fluctuations, has helped the country in having a stabilised economy. The Australian economy is among the strongest economies and this has been revealed through the specification of the steps or actions it took for controlling the fluctuations in the property market. The impact of the fluctuations could have been more aggressive and powerful if the right decisions on the foreign investment and supply and demand was not taken. The impact has been on both the macro and the micro economies but the macroeconomics has been quite strongly impacted. The changes in the micro economy, impacted the macro economy. The supply and the demand aspect of the property market has provided the specification to the issue of fluctuation and the acknowledgement has provided with productive information too.

Get readymade HC1072 Economics and International Trade Assignment Help solutions – 100% plagiarism free work document at nominal charges!